How to Verify a Foreign Exchange Trading Account by Using an Investor Password

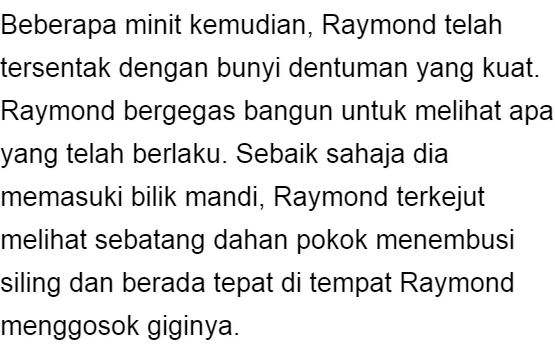

Various tools, artificial intelligence, and networked markets have converged to produce phenomenal investment opportunities.

Maybe you know what the Foreign Exchange Market (or Forex) is. If you don't, the following paragraph will briefly introduce these. (If you do know what these are, feel free to skip the next paragraph).The Foreign Exchange market is a worldwide exchange, running in multiple countries, where investors trade international currencies in an attempt to exploit (profit from) price fluctuations in currencies. Trillions of dollars are exchanged on the market daily, and the primary markets are in Australia, Japan, England, and the United States (in New York).

It can be a highly volatile market, which translates to great potential gain - or loss.There are various manual and automated ways to trade the Forex. Manual ways include training to read the "technicals", or various things about Forex currency charts, and indicator systems, etc. An automated way is to use a Forex Robot. A Forex Robot is a program that analyzes the Forex market and places trades automatically. Because in any one of the primary Forex markets there will always be daylight (and therefore working and trading hours), you can run a robot around the clock while the Forex is open, 24 hours a day during a trading week.In the vast sea Forex investing opportunities, there are many honest salesmen with useful and valuable tools available to assist in trading. Unfortunately, there are also dishonest salesemen, whom we will simply call pirates, who will swindle you out of cash by claiming amazing results from whatever method or tool they are selling.

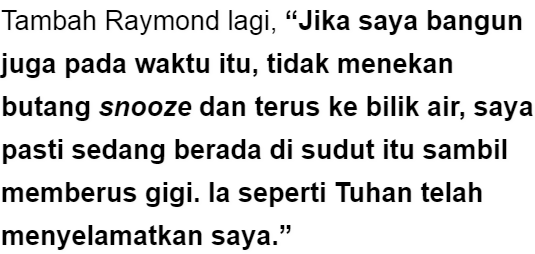

But it may be that in fact the odds are against you obtaining the same results, or worse, the odds may favor terrible results.(For that matter, there is always risk in Forex or any kind of investing, and you should never invest money you can't afford to lose. Only truly discretionary funds should be used for investing.)These pirates may show you an internet-published Forex account statement (which would show open and closed Foreign Exchange trades, profit etc.), but with either part or all of the statement secretly removed, to avoid showing poor or losing trades. It could also be that the entire statement is a forgery!Is there a way to be certain whether a published statement is real and accurate? Yes. If you are provided an investor password, account number, and server information, you can connect to a Demo or Live Forex trading account in read-only mode.

Read-only mode means you can view all trading information, but can't place trades or otherwise manipulate the account. But the data comes direct from the brokerage account. It can be like visiting Aladdin's Cave without being allowed to touch a thing.The following steps tell how to use an investor password in MetaTrader, which is a program used by many Forex brokers to allow customers to place trades over the internet from a computer.

1. Obtain the account number, investor password, and server information from the organization or individual who is showcasing their account for you.

2. Download the appropriate MetaTrader platform from their broker (this program runs, I believe, on Windows only). Many brokers prefer you open a demo account via their web site before providing access to their MetaTrader download link, although you may be able to find a direct download link at the broker by doing a web search.

3. Once you have the MetaTrader installer downloaded, run it. You'll then have icon(s) in you Windows Start Menu and/or on your Desktop. Click (or on the Desktop, double-click) either to run MetaTrader. When MetaTrader starts, it may prompt you to create a Demo Account, which isn't necessary (you can "x out" of that box.) The main screen that comes up may look like the following (partial screen).

4.As you can see in the screen-shot, your first step in the program is to go to the File->Login menu (click "Login"). This will bring up a prompt to log in.

5.In the "Login" field of the box, enter the account number. Obviously, enter the password in the "Password" field. In the Server field, you can either select the proper server from the drop-down menu (if it matches what you were given), or depending, you can manually type in a server address (there are situations where you'll type in something like account.domain.com). Whether to check "Save account information" is up to you. Then click the "Login" button.

6.If all goes well, it will log in to the investment account, and load the open and closed trade history, used margin, account balance etc. It may take some moments to load.

7.If the "Terminal" (with tabs that say "Trade", "Account History", "Alerts" etc.) isn't displayed already, click the "Terminal" button on the toolbar to display it:

Or click on the View->Terminal menu.

8.Now you can examine account details. In the Terminal, the "Trade" tab displays any currently open trades (which display negative immediately after they are opened, as it costs money to open trades - hopefully, most or even all trades move into the positive, and can then be closed for a profit).

You can see that the "Trade" tab also displays the current account balance, Equity (the value of the account plus and/or minus currently open trades), Margin (how much is currently borrowed from the broker for leverage on open trades), etc.One thing to watch for: a well-traded account will never see the Margin level approach anywhere even remotely near 100%. If it does reach 100%, what that means is that the negative balance of open trades is growing large enough to threaten the amount of Equity required by the broker (it varies per broker) to offset potential losses. (Another way to describe this is that the broker's Margin requirement has been exceeded.)

If Equity falls too low, it is shown by the Margin level reaching 100% - at which point the broker will issue a "Margin call" - which means they liquidate or close all open trades, at a potentially massive loss, both to the broker and the account holder!In my opinion, keeping Margin level above 800%, and ideally well above 1,000%, is safest. The higher the percent shown for the Margin level, the better.

What makes a Margin level safe depends on a variety of factors - like the broker's Margin requirement, the volatility of the currency pairs being traded, the number of open trades, the cash available in the account, and the leverage ratio used in the account. It's complicated - just remember that above 800% may be seen as safer - but again, well above 1,000% may be ideal. The higher, the better.The Account History tab displays the history of closed trades. You'll note a wide line separator at the top of the Terminal that can be clicked and dragged to extend the panel higher, so you can more easily view the trade history.

The "Profit" column in the Account History tab reflects how much is lost or gained for each trade. Consistent positive numbers are what you (obviously) want here, the larger the positive numbers the better - unless they were obtained by opening too much margin, or letting Equity drift below what is safe.

If this Account History statement matches what you were shown by the person who gave you the Investor Password, you know, obviously, they're representing reality to you. You can then use this information to make a much more informed investment decision, or to decide whether to invest at all.You may be able to see from the image that (unless I'm lying to you!) this particular Demo account has a very good trading history for a $500 deposit. $64.71 profit on a $500 deposit in 5 trading days = $64.71 / $500 = 0.12942 = about 13% profit in five trading days. If things continue at that pace for a year, this account will be in very great shape.

For more information about methods of leveraged or automated income, including the use of a "Forex Robot" with an investor password-verifiable statement showing 354% percent increase in 19 trading days